A Presentation Evaluation Template is a structured document designed to assess the quality and effectiveness of a presentation. It provides […]

Creative Template Ideas for Any Project

Elevate Your Presentations: A Collection Of Professional Prezi Templates

Prezi Presentation Templates are the digital canvases upon which you paint your ideas. They are more than just slides; they […]

History Of Present Illness Template

A well-structured History of Present Illness (HPI) template is a crucial tool for healthcare providers to effectively document patient encounters. […]

Program Agenda Template

A Program agenda Template is a structured outline that details the sequence of events, speakers, and timings for a specific […]

Case Presentation Template

A Case Presentation Template serves as a visual framework to articulate complex ideas, data, and arguments in a clear and […]

Workshop Agenda Template

A Workshop agenda Template is a structured outline that provides a clear roadmap for your workshop. It serves as a […]

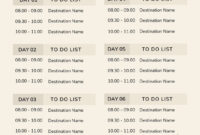

Travel Itinerary Template

A well-structured Travel agenda Template is an indispensable tool for organizing and streamlining travel plans. It serves as a roadmap, […]

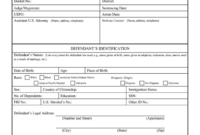

Pre-Sentence Investigation Report Template

A Presentence Investigation report (PSIR) is a crucial document prepared by probation officers or other court officials. It provides a […]

Listing Presentation Template: A Professional Guide

A Listing Presentation Template is a professionally designed document that real estate agents use to pitch their services to potential […]

Committee Meeting Agenda Template

A well-structured Committee meeting agenda Template is the cornerstone of effective and efficient meetings. It serves as a roadmap, guiding […]