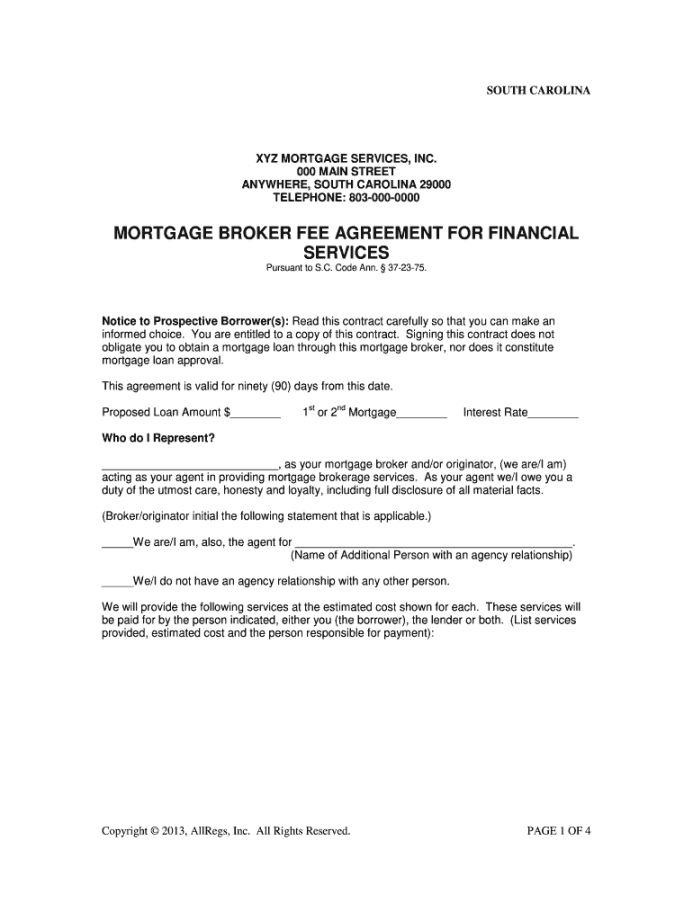

A Commercial Mortgage Broker Fee Agreement Template is a crucial legal document that outlines the terms and conditions between a commercial mortgage broker and a client. This agreement clearly defines the services provided by the broker, the fees charged, and the responsibilities of both parties. A well-drafted agreement ensures transparency, accountability, and a smooth business relationship.

Key Elements of a Commercial Mortgage Broker Fee Agreement Template

1. Parties Involved

Image Source: pdffiller.com

Broker: The commercial mortgage broker providing services.

2. Services Provided

Property Identification: Assisting the client in identifying suitable properties for investment or refinancing.

3. Broker’s Fee

Fee Structure: Clearly outline the fee structure, whether it’s a flat fee, percentage-based fee, or a combination of both.

4. Client’s Responsibilities

Financial Information: Providing accurate and complete financial information.

5. Broker’s Responsibilities

Professional Services: Providing professional and diligent services.

6. Termination

Termination Rights: Outline the circumstances under which either party may terminate the agreement.

7. Governing Law and Dispute Resolution

Governing Law: Indicate the jurisdiction whose laws will govern the agreement.

8. Entire Agreement

Entire Agreement Clause: State that the agreement constitutes the entire understanding between the parties.

Design Considerations for a Professional Agreement

A well-designed agreement not only protects the interests of both parties but also reflects the professionalism of the broker. Here are some design elements to consider:

Clear and Concise Language: Use plain language and avoid legal jargon.

Additional Tips

Customize the Template: Tailor the template to your specific business needs and practices.

By following these guidelines and incorporating these design elements, you can create a professional and effective Commercial Mortgage Broker Fee Agreement Template that safeguards your business interests and fosters strong relationships with your clients.