A Share Buyback Agreement is a legally binding contract between a company and its shareholders outlining the terms and conditions of a share repurchase program. This document is crucial for ensuring transparency, fairness, and compliance with regulatory requirements. A well-crafted template can streamline the buyback process and protect the interests of all parties involved.

Key Elements of a Share Buyback Agreement Template

A robust Share Buyback Agreement should incorporate the following essential elements:

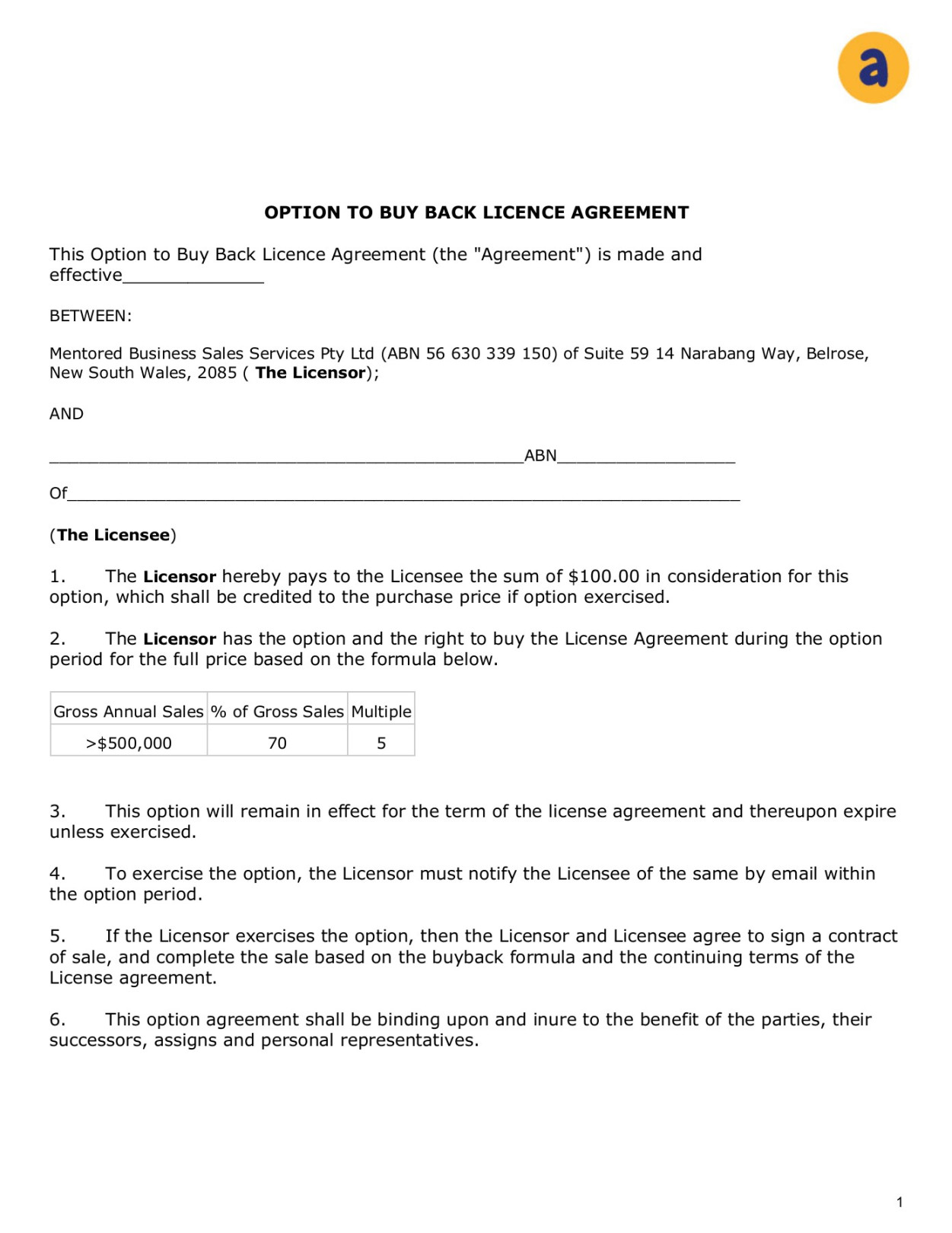

Image Source: pubhtml5.com

1. Parties to the Agreement

Company: Clearly identify the company initiating the share buyback program, including its legal name, address, and jurisdiction of incorporation.

2. Purpose of the Buyback

Image Source: rocketlawyer.com

Business Rationale: Articulate the specific reasons for the share buyback, such as capital structure optimization, shareholder value enhancement, or market price stabilization.

3. Offer Price and Payment Terms

Purchase Price: Clearly state the offer price per share, which may be a fixed price or a formula-based calculation.

4. Tender Period and Procedures

Tender Period: Define the specific timeframe during which shareholders can tender their shares for repurchase.

5. Maximum Number of Shares to be Repurchased

6. Conditions Precedent

Regulatory Approvals: Outline any necessary regulatory approvals or consents required before the buyback can proceed.

7. Representations and Warranties

Company Representations: Include representations and warranties from the company regarding its financial condition, legal status, and compliance with applicable laws.

8. Indemnification

9. Governing Law and Dispute Resolution

Governing Law: Indicate the jurisdiction whose laws will govern the agreement.

10. Termination and Modification

Termination Events: Specify the circumstances under which either party may terminate the agreement, such as regulatory changes or material adverse events.

Design Tips for a Professional Share Buyback Agreement Template

Clear and Concise Language: Use plain language and avoid legal jargon to ensure clarity and understanding.

By carefully considering these elements and design tips, you can create a professional and effective Share Buyback Agreement template that safeguards the interests of all parties involved.