A Promise to Pay Agreement is a legally binding document that outlines a debtor’s commitment to repay a creditor a specific sum of money within a designated timeframe. It’s a crucial tool for businesses and individuals alike, providing a clear and enforceable framework for debt repayment.

Key Elements of a Promise to Pay Agreement

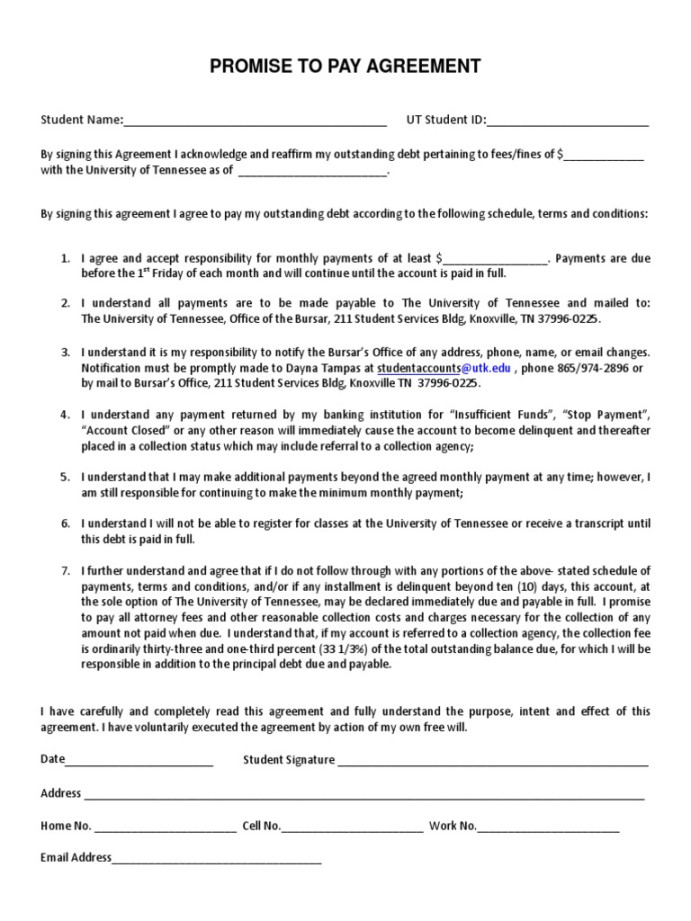

A well-crafted Promise to Pay Agreement should include the following essential elements:

1. Parties Involved

Image Source: scribdassets.com

Debtor: The individual or entity owing the debt.

2. Debt Amount

Principal Amount: The total amount of the debt, excluding any interest or fees.

3. Payment Schedule

Payment Amount: The amount to be paid in each installment.

4. Default and Late Payment

Default: Defines the conditions under which the debtor is considered to be in default (e.g., missed payments, failure to comply with other terms).

5. Governing Law and Dispute Resolution

Governing Law: Identifies the jurisdiction whose laws will govern the agreement.

Designing a Professional Template

To create a professional and effective Promise to Pay Agreement template, consider the following design elements:

1. Clear and Concise Language

Avoid Legal Jargon: Use plain language that is easy to understand for both legal and non-legal audiences.

2. Consistent Formatting

Font: Choose a professional and easy-to-read font, such as Times New Roman or Arial.

3. Professional Layout

Header: Include the title of the document, the names of the parties involved, and the date.

4. Use of Legal Language When Necessary

While it’s important to avoid excessive legal jargon, there are certain legal terms and phrases that are essential to include in a Promise to Pay Agreement. These terms should be used accurately and consistently throughout the document.

Example Template Structure

[Your Company Logo]

Promise to Pay Agreement

This Promise to Pay Agreement (the “Agreement”) is made and entered into as of [Date] by and between [Debtor’s Name] (“Debtor”) and [Creditor’s Name] (“Creditor”).

1. Debt Acknowledgment

Debtor acknowledges that they owe Creditor the sum of [Principal Amount] (“Principal Amount”).

2. Payment Schedule

Debtor agrees to repay the Principal Amount in [Number] installments of [Payment Amount] each, due on the [Day] day of each [Month], beginning on [Start Date] and continuing until the Principal Amount is fully repaid.

3. Interest

Interest shall accrue on the unpaid balance of the Principal Amount at a rate of [Interest Rate]% per annum.

4. Default

Debtor shall be in default if they fail to make any payment when due.

5. Late Fees

If Debtor fails to make any payment when due, a late fee of [Late Fee Amount] will be charged.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of [State].

7. Dispute Resolution

Any disputes arising out of or in connection with this Agreement shall be resolved through [Dispute Resolution Method], such as mediation or arbitration.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

[Debtor’s Signature] [Creditor’s Signature]

[Debtor’s Printed Name] [Creditor’s Printed Name]

[Date] [Date]

Additional Tips for Creating a Professional Template

Proofread Carefully: Ensure that there are no errors in grammar, spelling, or punctuation.

By following these guidelines, you can create a professional and effective Promise to Pay Agreement template that will protect your interests and ensure timely repayment of your debt.