A Personal Loan Repayment Agreement is a legally binding document that outlines the terms and conditions of a personal loan between a lender and a borrower. This document is crucial for both parties, as it ensures transparency, accountability, and protection of their interests. A well-crafted agreement can prevent misunderstandings and disputes down the line.

Key Elements of a Personal Loan Repayment Agreement Template

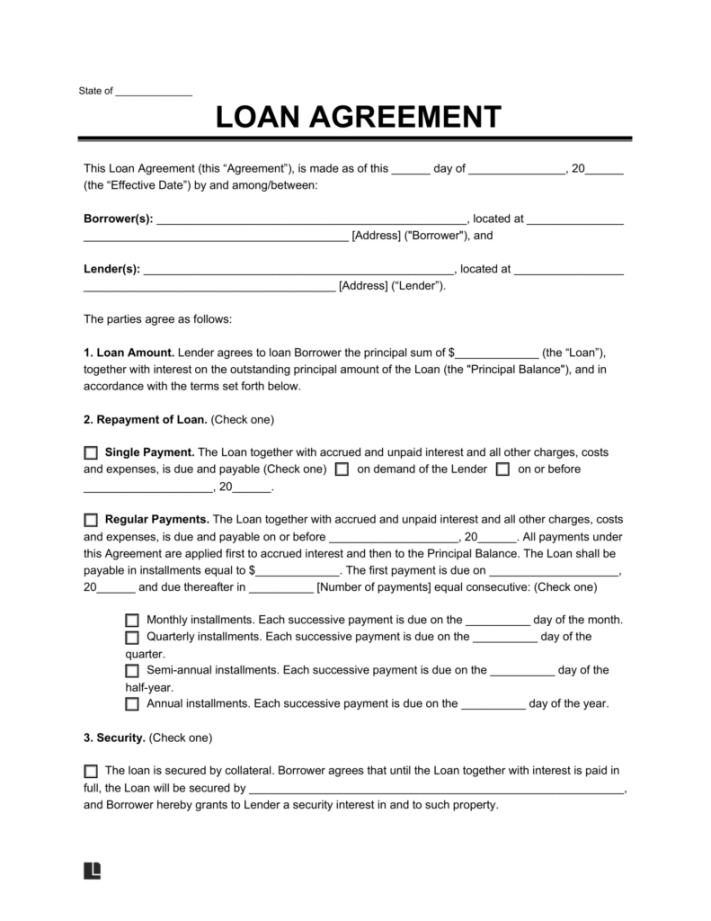

A comprehensive personal loan repayment agreement template should include the following essential elements:

Image Source: legaltemplates.net

1. Borrower and Lender Information:

Full Legal Names: Clearly specify the full legal names of both the borrower and the lender.

2. Loan Amount and Terms:

Principal Amount: State the exact amount of money being loaned.

3. Repayment Method:

Payment Options: Specify the accepted payment methods (e.g., checks, online transfers, automatic deductions).

4. Default and Remedies:

Default Definition: Define what constitutes a default, such as missed payments or failure to comply with other terms.

5. Governing Law and Dispute Resolution:

Governing Law: Indicate the jurisdiction whose laws will govern the agreement.

6. Additional Terms and Conditions:

Prepayment: Specify whether early repayment is allowed and if there are any associated fees or penalties.

Designing a Professional Template

When creating a personal loan repayment agreement template, consider the following design elements to enhance its professionalism and trustworthiness:

1. Clear and Concise Language:

Plain Language: Use clear and simple language that is easy to understand.

2. Professional Formatting:

Consistent Formatting: Use consistent fonts, font sizes, and spacing throughout the document.

3. Visual Appeal:

Clean Layout: Use a clean and uncluttered layout.

4. Legal Disclaimer (Optional):

Consult an Attorney: Consider adding a disclaimer that encourages both parties to consult with an attorney to review the agreement.

Conclusion

A well-crafted personal loan repayment agreement template is essential for protecting the interests of both the lender and the borrower. By following these guidelines and incorporating the key elements discussed above, you can create a professional and legally sound document that will help to ensure a smooth and successful loan transaction.