An invoice Discounting Agreement is a legal contract between a business (the “Borrower”) and a financial institution (the “Financier”) that allows the Borrower to receive immediate cash flow by selling its unpaid invoices to the Financier at a discount. This agreement outlines the terms and conditions of this financial transaction, ensuring both parties are protected.

Key Components of an Invoice Discounting Agreement Template

A well-crafted Invoice Discounting Agreement should include the following essential components:

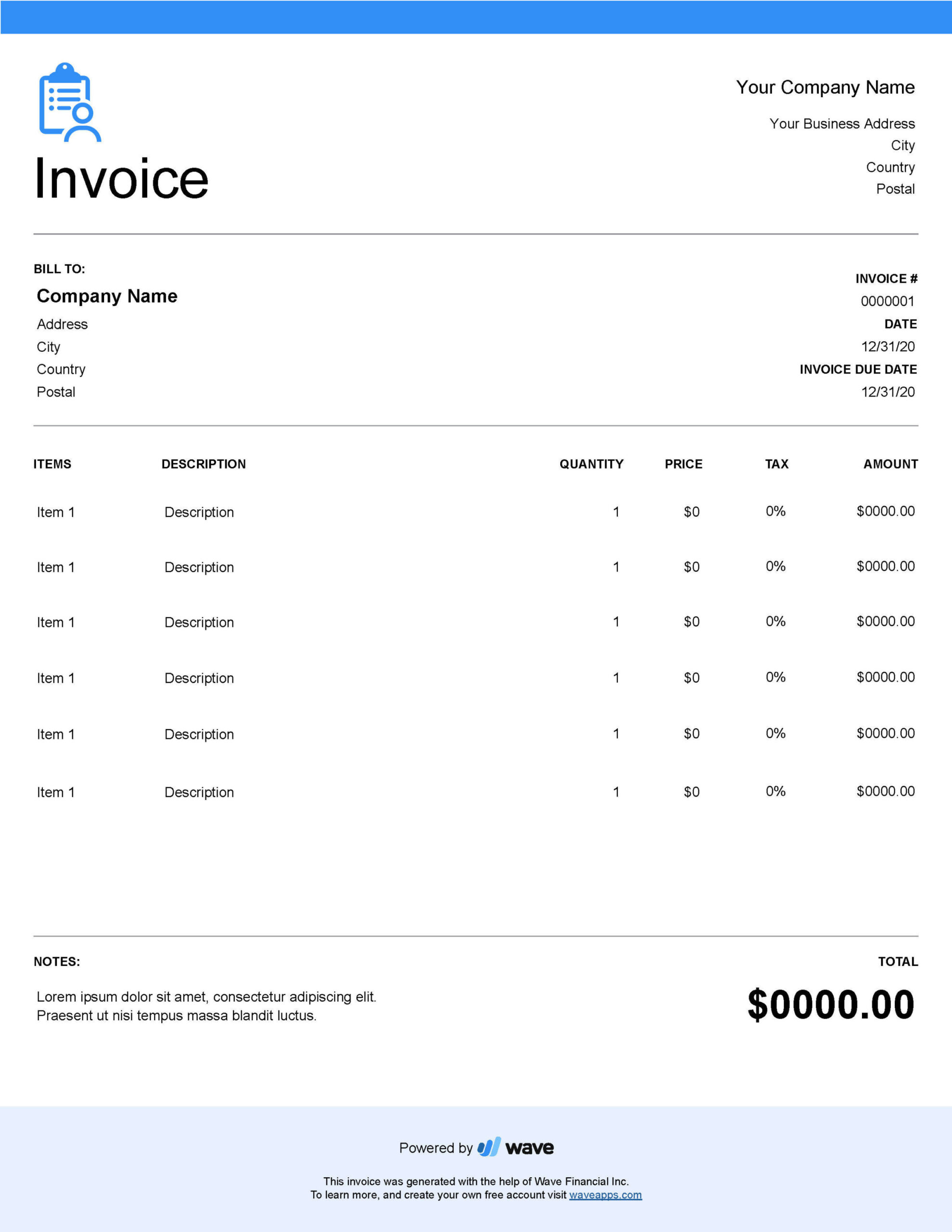

Image Source: website-files.com

1. Parties to the Agreement

Borrower: Clearly identify the business entity seeking the invoice discounting facility.

2. Definitions

Invoice: Define the specific type of invoices eligible for discounting, such as sales invoices, service invoices, or purchase orders.

3. Invoice Eligibility Criteria

Origin: Specify the origin of the invoices, such as domestic or international.

4. Financing Process

Invoice Submission: Detail the process for submitting invoices to the Financier, including required documentation and timelines.

5. Security and Collateral

Security Interest: Outline the specific assets or receivables that will serve as collateral for the advance.

6. Default and Remedies

Events of Default: Clearly define the events that would constitute a default by the Borrower, such as late payments, breach of contract, or insolvency.

7. Representations and Warranties

Borrower’s Representations: Require the Borrower to make certain representations and warranties about its financial condition, business operations, and the validity of the invoices.

8. Governing Law and Dispute Resolution

Governing Law: Specify the jurisdiction whose laws will govern the agreement.

9. Confidentiality

10. Termination

Termination Events: Specify the events that may trigger the termination of the agreement, such as default, insolvency, or mutual agreement.

Designing a Professional Invoice Discounting Agreement Template

To create a professional and trustworthy Invoice Discounting Agreement Template, consider the following design elements:

Clear and Concise Language: Use plain language and avoid legal jargon.

By carefully considering these elements, you can create an Invoice Discounting Agreement Template that is both legally sound and easy to understand.