A certificate of Insurance (COI) is a crucial document that verifies insurance coverage for a specific project, event, or rental property. It’s often required by landlords, event organizers, and clients to ensure that potential risks are mitigated. To maintain a professional image and streamline your business processes, creating a well-designed COI template is essential.

Core Elements of a COI Template

A standard COI typically includes the following information:

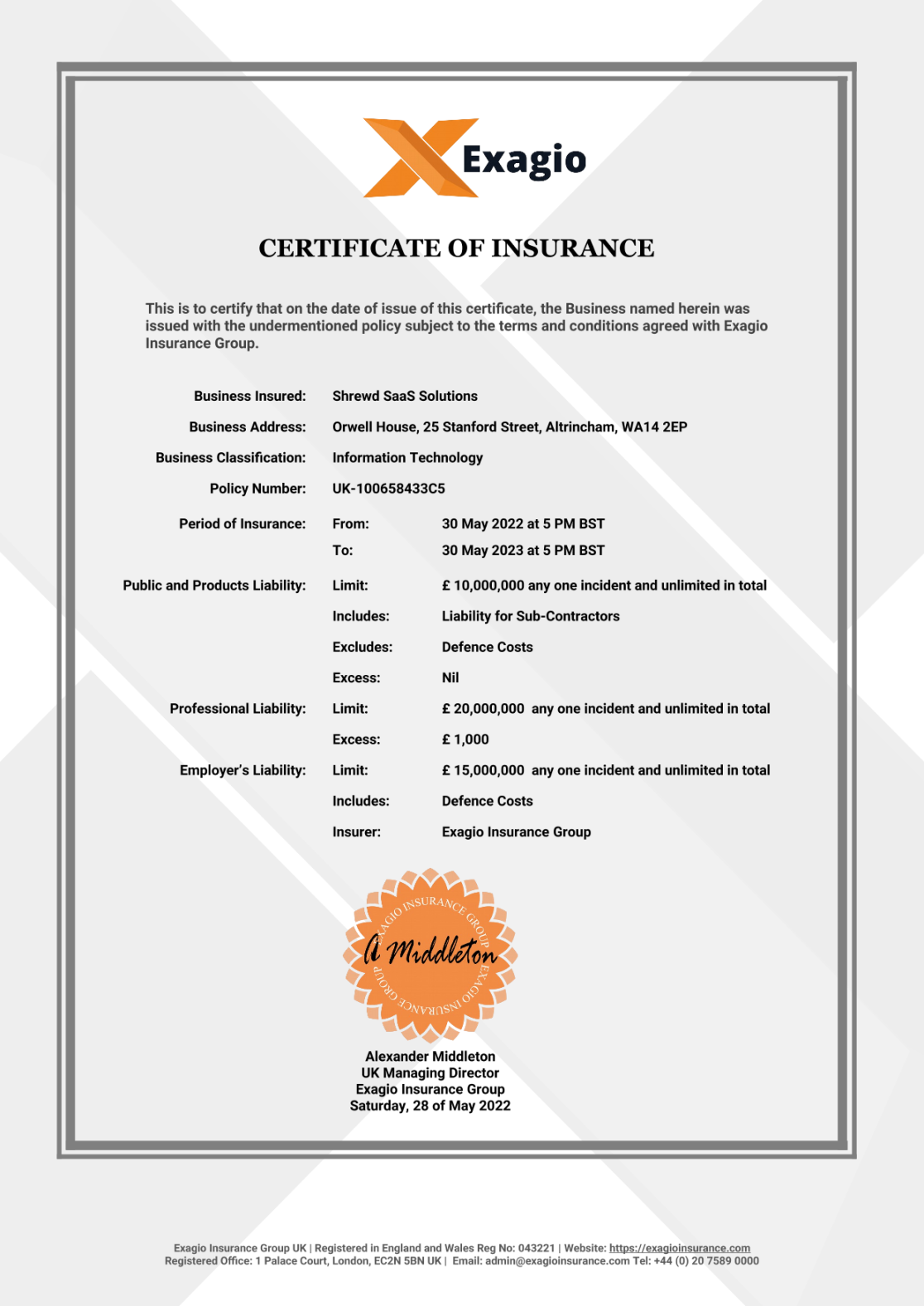

Image Source: docmosis.com

1. Issuing Insurance Company:

Company Logo: A prominent and recognizable logo of the insurance company.

2. Insured Party:

Name of Insured: The full legal name of the individual or organization covered by the insurance policy.

3. Policy Period:

Effective Date: The date when the insurance policy becomes effective.

4. Coverage Information:

Policy Number: A unique identifier for the insurance policy.

5. Additional Endorsements:

6. Certificate Holder:

Name of Certificate Holder: The name of the individual or organization requesting the COI.

Design Considerations for a Professional COI Template

A well-designed COI template not only provides essential information but also reflects the professionalism of your business. Consider the following design elements:

1. Layout and Formatting:

Clean and Minimalist Design: A clean and uncluttered layout enhances readability.

2. Visual Hierarchy:

Bold Headings: Use bold headings to highlight important information.

3. Color Palette:

Professional Color Scheme: Choose a color scheme that is professional and visually appealing.

4. Typography:

Readable Fonts: Choose fonts that are easy to read, such as Arial, Times New Roman, or Helvetica.

5. Logo Placement:

6. Security Features:

Watermark: Add a subtle watermark to the background to deter unauthorized use.

Using a COI Template in WordPress

While WordPress is primarily a content management system for websites, you can leverage its flexibility to create and manage COI templates. Here are a few approaches:

1. Custom Post Type:

Create a custom post type for COIs to store specific information like policy number, insured party, and coverage details.

2. PDF Generator Plugin:

Use a PDF generator plugin to dynamically create COIs based on data from your website or a database.

3. Form and Email Integration:

Create a form for clients to request COIs.

By carefully considering these design elements and leveraging the power of WordPress, you can create a professional and efficient COI template that strengthens your business relationships and protects your interests.