A collateral loan agreement template is a legal document that outlines the terms and conditions of a loan secured by collateral. It’s a crucial tool for both lenders and borrowers to protect their interests. A well-drafted template ensures clarity, transparency, and legal enforceability.

Essential Elements of a Collateral Loan Agreement Template

A comprehensive collateral loan agreement template should include the following key elements:

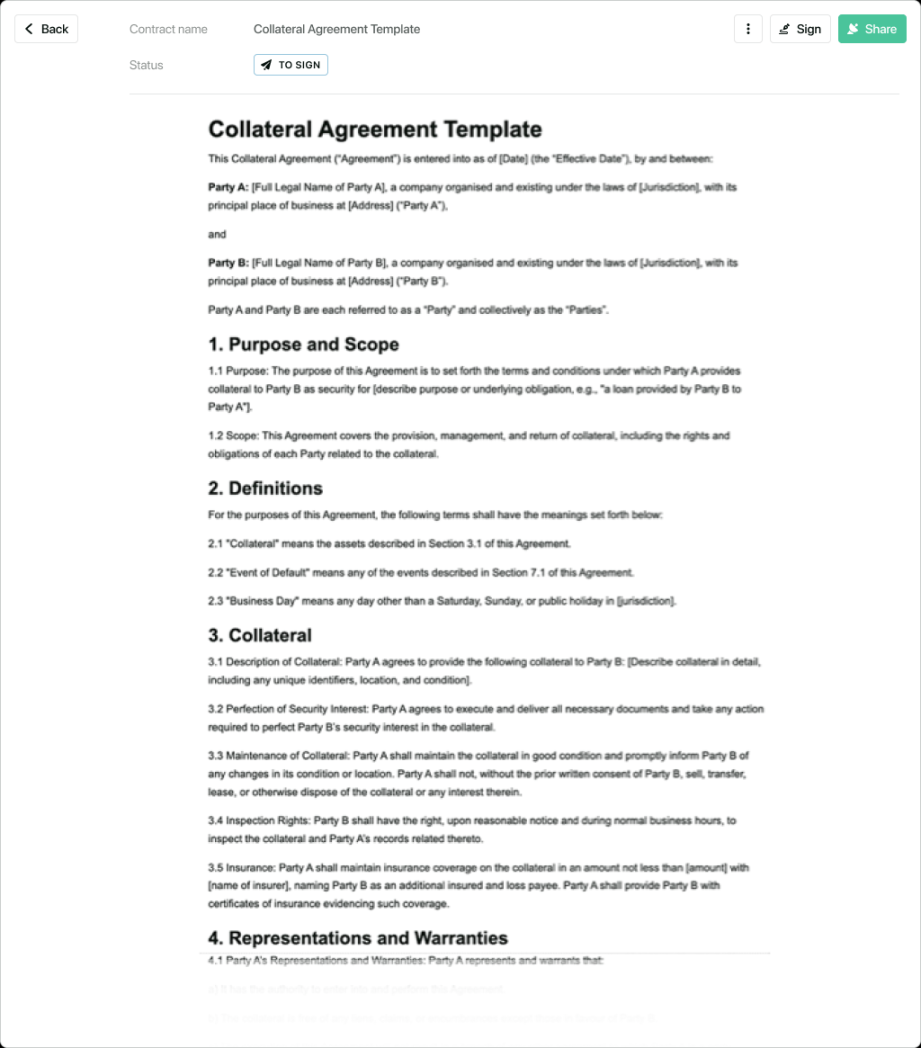

1. Parties Involved

Image Source: website-files.com

Lender: Clearly identify the lender, including their legal name and address.

2. Loan Amount and Terms

Principal Amount: Clearly state the total amount of the loan.

3. Collateral Description

Collateral Identification: Provide a detailed description of the collateral, including its type, quantity, and any relevant identification numbers.

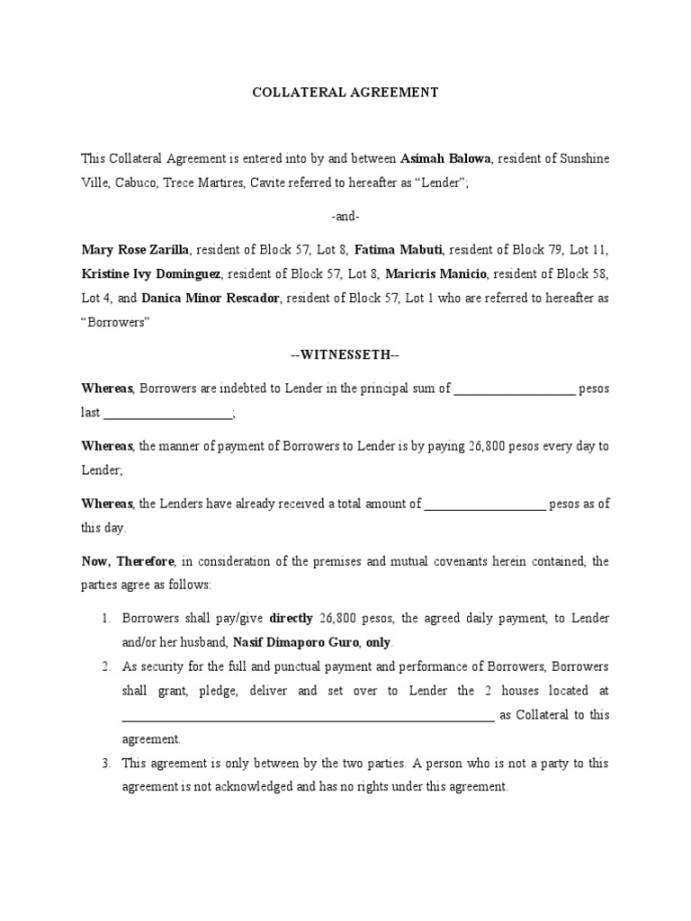

4. Rights and Obligations of the Parties

Image Source: scribdassets.com

Lender’s Rights: Outline the lender’s rights, such as the right to sell the collateral in case of default.

5. Events of Default

Default Events: Clearly define the events that would constitute a default, such as failure to make payments or breach of other terms.

6. Governing Law and Dispute Resolution

Governing Law: Indicate the jurisdiction whose laws will govern the agreement.

Design Considerations for a Professional Template

To create a professional and trustworthy collateral loan agreement template, consider the following design elements:

Clear and Concise Language: Use plain language and avoid legal jargon.

Additional Tips for Creating an Effective Template

Consult with a Legal Professional: While a template can be a helpful starting point, it’s essential to consult with an attorney to ensure the agreement is legally sound and tailored to your specific needs.

By carefully considering these elements and design principles, you can create a professional and effective collateral loan agreement template that protects the interests of both the lender and the borrower.