A Credit card Billing Authorization Form Template is a crucial document used to obtain explicit permission from a cardholder to charge their credit card for a specific amount. It serves as a legally binding agreement between the service provider and the cardholder, ensuring transparency and accountability in financial transactions.

Key Elements of a Professional Credit Card Billing Authorization Form Template

To create a professional and effective Credit Card Billing Authorization Form Template, consider incorporating the following essential elements:

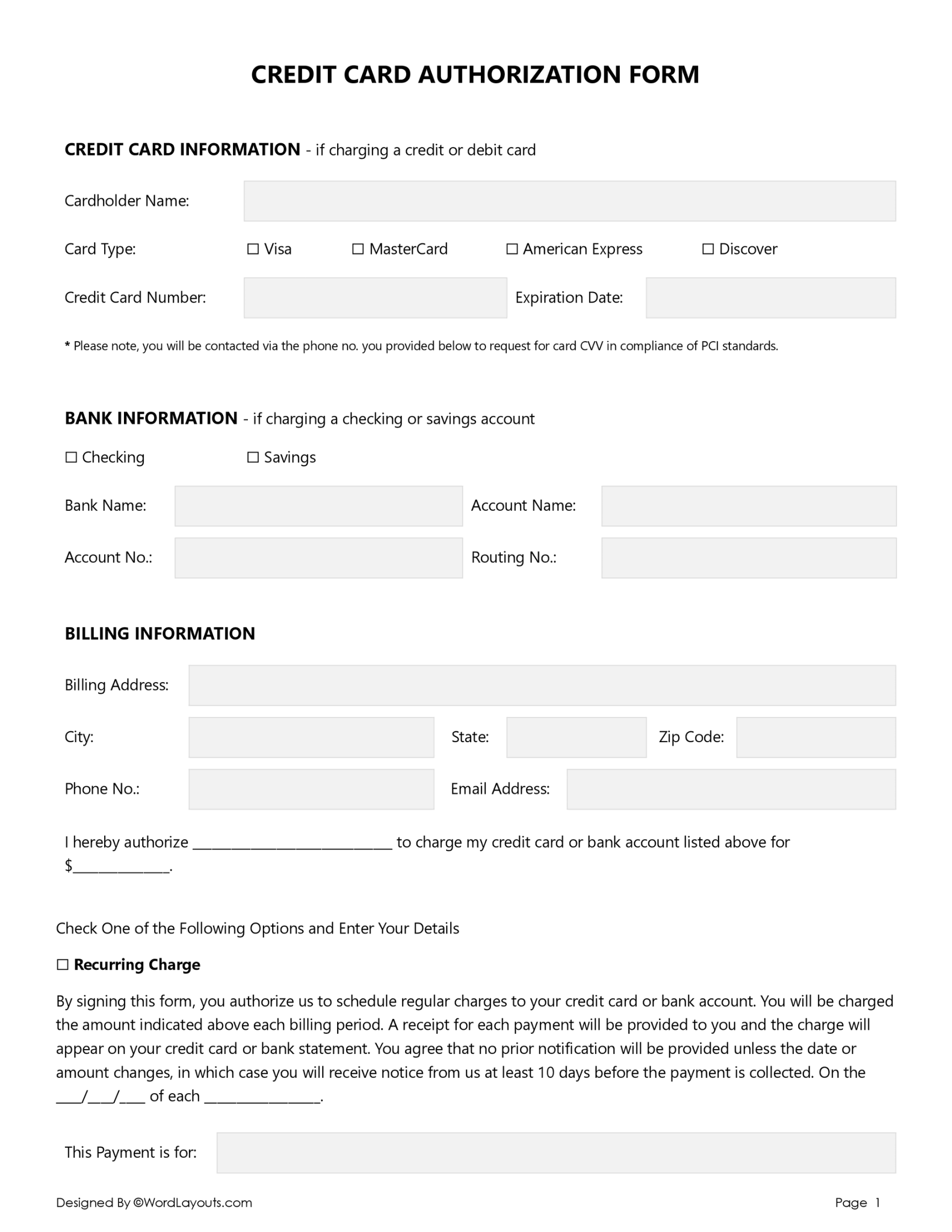

Image Source: wordlayouts.com

1. Clear and Concise Heading

A Strong Headline: Use a clear and concise headline that immediately conveys the purpose of the form. For example, “Credit Card Authorization Form.”

2. Company Logo and Contact Information

Company Logo: Position your company’s logo prominently at the top of the form. Ensure it is high-quality and easily recognizable.

3. Cardholder Information

Full Name: Request the cardholder’s full name to accurately identify the account holder.

4. Credit Card Information

Cardholder Name: Request the name as it appears on the credit card to match the billing information.

5. Amount to be Charged

Itemized List: If multiple items or services are being charged, provide a detailed, itemized list of charges, including quantities, descriptions, and unit prices.

6. Authorization Signature

Signature Line: Provide a clear signature line for the cardholder to sign, indicating their consent to the charges.

7. Payment Terms and Conditions

Payment Schedule: If applicable, specify any payment schedules or installment plans.

8. Privacy Policy

Data Protection: Assure the cardholder that their personal and financial information will be protected and used solely for the purpose of processing the payment.

9. Form Layout and Design Considerations

Professional Typography: Use a clean and professional font that is easy to read, such as Arial or Times New Roman.

10. Legal and Compliance Considerations

PCI DSS Compliance: Adhere to the Payment Card Industry Data Security Standard (PCI DSS) to protect sensitive cardholder data and prevent data breaches.

By carefully considering these elements and design principles, you can create a professional and effective Credit Card Billing Authorization Form Template that inspires trust and facilitates smooth financial transactions.