Defining the Purpose

A Credit card On File Form Template is a digital document that securely captures and stores a customer’s credit card information for future transactions. It is a crucial tool for businesses that require recurring payments, subscriptions, or one-click purchasing options. These templates streamline the checkout process, enhance customer experience, and boost sales.

Key Design Principles for Professionalism and Trust

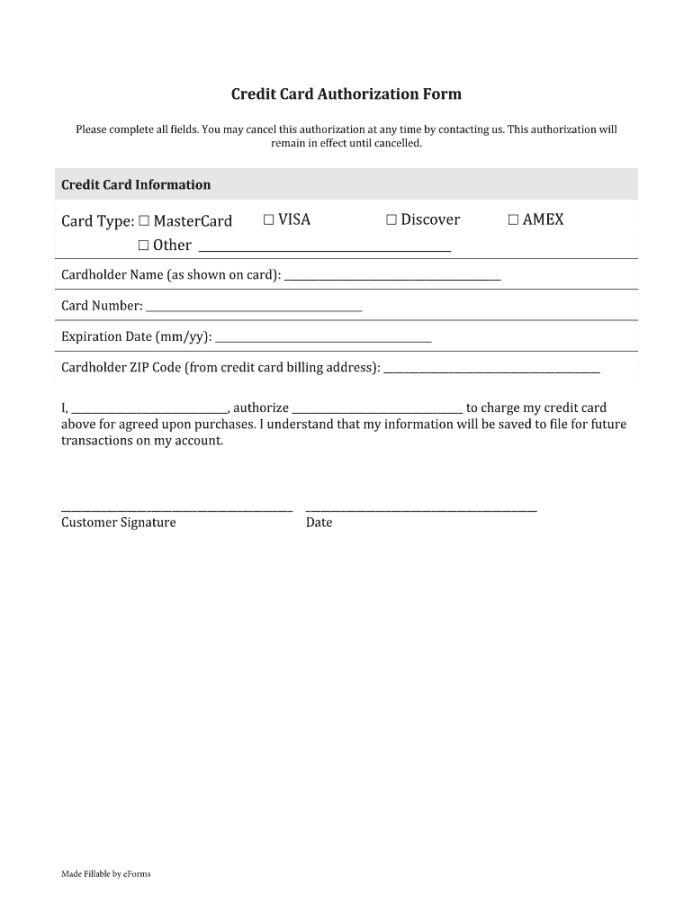

Image Source: pdffiller.com

Clear and Concise Layout:

A well-organized layout guides users through the form effortlessly. Use clear headings, labels, and instructions to eliminate confusion. Avoid clutter and excessive text, as it can overwhelm users.

Consistent Branding:

Incorporate your brand’s colors, fonts, and logo into the template. This reinforces brand recognition and builds trust. Maintain consistency throughout the form to create a cohesive and professional look.

Secure Payment Gateway Integration:

A secure payment gateway is essential for protecting sensitive credit card information. Choose a reputable gateway that encrypts data and adheres to industry standards like PCI DSS.

User-Friendly Navigation:

The form should be intuitive and easy to navigate. Use clear and concise language, and avoid technical jargon. Consider using progressive disclosure to minimize form fatigue, revealing additional fields as needed.

Mobile Responsiveness:

Optimize the template for various screen sizes, ensuring a seamless experience across devices. Mobile responsiveness is crucial in today’s mobile-first world.

Essential Form Fields

Cardholder Name:

This field should be mandatory and clearly labeled.

Ensure a secure input field that automatically formats the card number into groups of four digits.

Provide separate fields for the month and year to prevent errors.

A separate field for the three-digit security code on the back of the card.

Include fields for street address, city, state/province, ZIP/postal code, and country.

Optional Fields

Phone Number:

For contact purposes, especially in case of issues with payments.

For sending receipts, notifications, and marketing communications.

A checkbox that allows customers to save their card details for future transactions.

Security Considerations

Encryption:

Implement strong encryption to protect sensitive data during transmission and storage.

Consider tokenization, which replaces actual card numbers with unique tokens.

Conduct regular security audits to identify and address vulnerabilities.

Adhere to PCI DSS standards to ensure secure handling of cardholder data.

legal and Compliance

Terms and Conditions:

Clearly outline the terms of service, including how card information will be stored and used.

Explain how customer data will be protected and used.

Stay up-to-date with relevant regulations, such as GDPR and CCPA, to ensure data privacy and security.

Best Practices for Form Design

Clear and Concise Labeling:

Use clear and concise labels for each field.

Use visual cues, such as font size, color, and spacing, to guide the user’s eye through the form.

Provide clear and helpful error messages to guide users in correcting mistakes.

For longer forms, consider using progress indicators to show users how far they have progressed.

Ensure the form is accessible to users with disabilities by following WCAG guidelines.

Testing and Optimization

User Testing:

Conduct user testing to identify usability issues and areas for improvement.

Experiment with different form designs to optimize conversion rates.

Track form performance metrics, such as completion rates and error rates, to identify areas for optimization.

By following these guidelines, you can create professional and secure Credit Card On File Form Templates that enhance the user experience and boost your business’s bottom line.