A credit terms agreement template is a standardized document that outlines the specific terms and conditions governing credit transactions between a business and its customers. It serves as a legally binding contract that protects both parties’ interests and ensures smooth financial operations.

Key Elements of a Credit Terms Agreement Template

A well-crafted credit terms agreement template should include the following essential elements:

![+ Simple Loan Agreement Templates [FREE] ᐅ TemplateLab + Simple Loan Agreement Templates [FREE] ᐅ TemplateLab](https://theroyalmen.com/wp-content/uploads/2024/11/simple-loan-agreement-templates-free-templatelab_0.jpg)

Image Source: templatelab.com

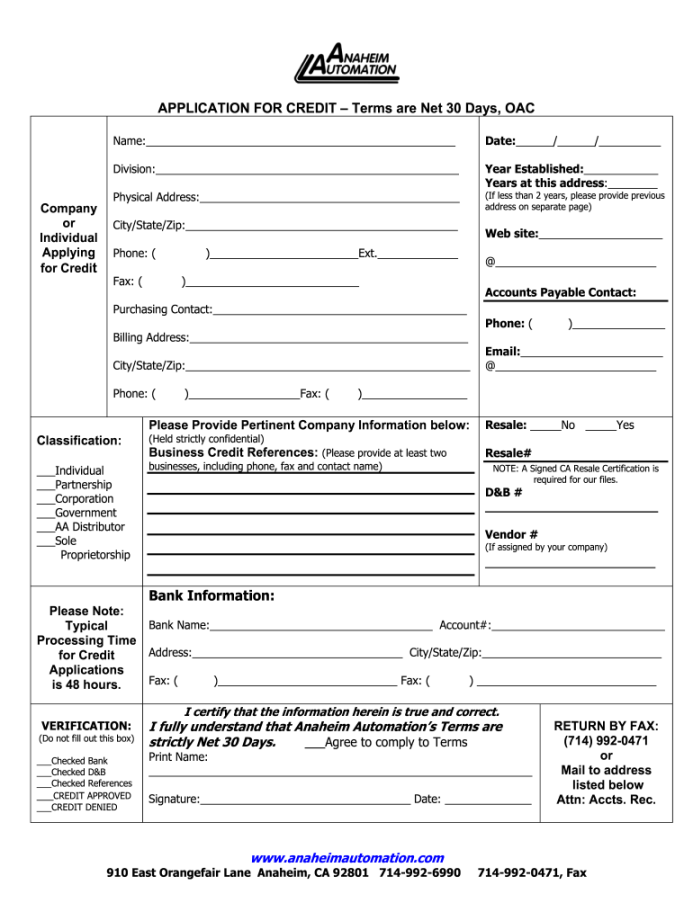

1. Party Information

Clearly identify the parties involved in the agreement: the creditor (your business) and the debtor (the customer).

2. Credit Limit

Image Source: pdffiller.com

Specify the maximum amount of credit that the creditor is willing to extend to the debtor.

3. Payment Terms

Clearly outline the payment terms, including the due date for each invoice and the accepted payment methods (e.g., check, credit card, wire transfer).

Image Source: lsta.org

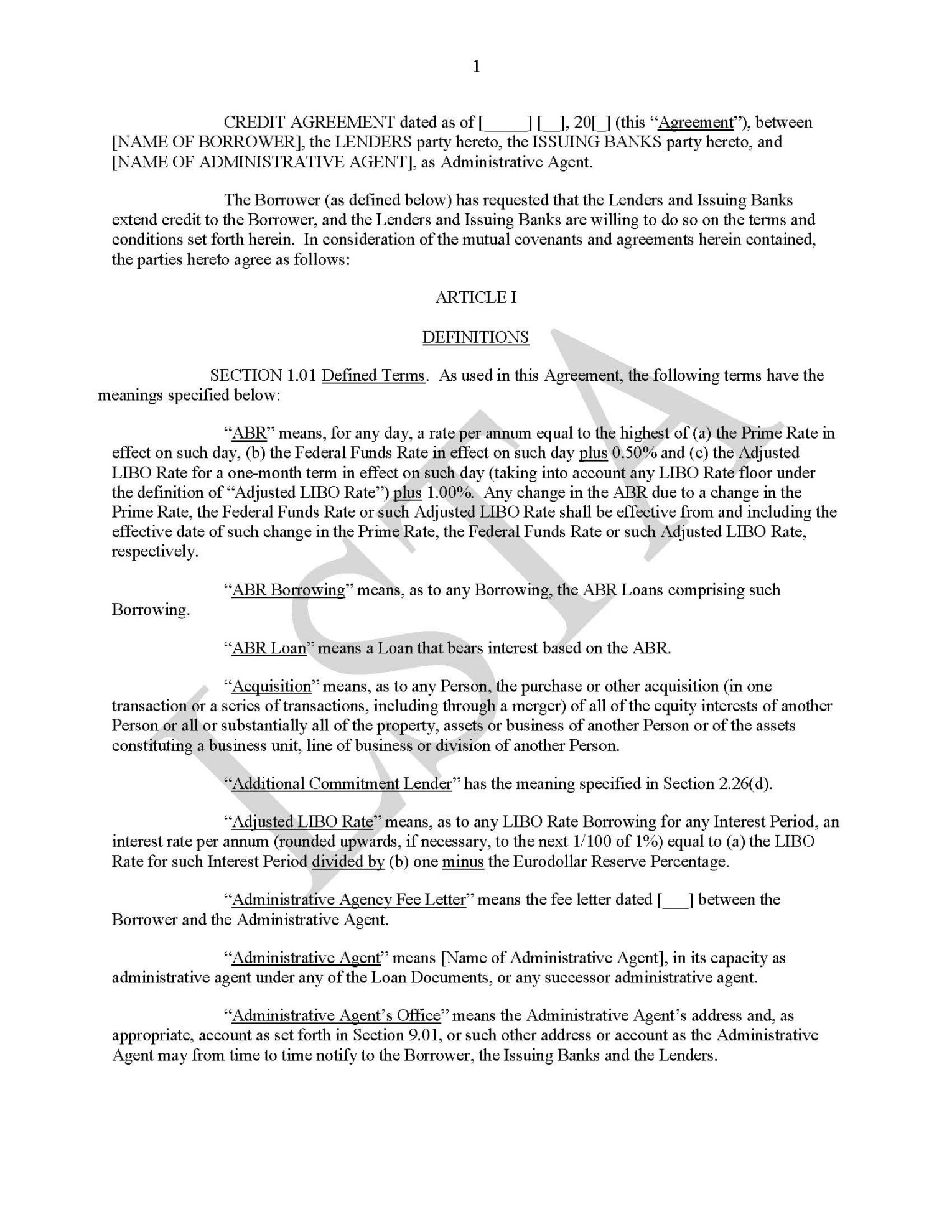

4. Interest Charges

If applicable, state the interest rate that will be charged on overdue balances.

5. Security Interest

If necessary, include provisions regarding any security interest that the creditor may hold over the debtor’s assets.

6. Default

Define what constitutes a default, such as failure to make timely payments or breach of other terms.

7. Governing Law

Specify the governing law that will apply to the agreement.

8. Dispute Resolution

Outline the procedure for resolving disputes, such as mediation or arbitration.

9. Entire Agreement

10. Severability

Design Considerations for a Professional Credit Terms Agreement Template

Clear and Concise Language: Use plain language and avoid legal jargon to ensure that the terms are easily understood by both parties.

Additional Tips for Creating a Strong Credit Terms Agreement Template

Review Existing Templates: If you have existing credit terms agreements, review them to identify best practices and areas for improvement.

By following these guidelines, you can create a professional and effective credit terms agreement template that protects your business interests and fosters strong relationships with your customers.