Understanding Debt Agreement Templates

Debt agreement templates are pre-formatted documents that outline the terms and conditions of a debt repayment plan between a lender and a borrower. These templates are essential tools for individuals and businesses to manage their financial obligations efficiently and legally.

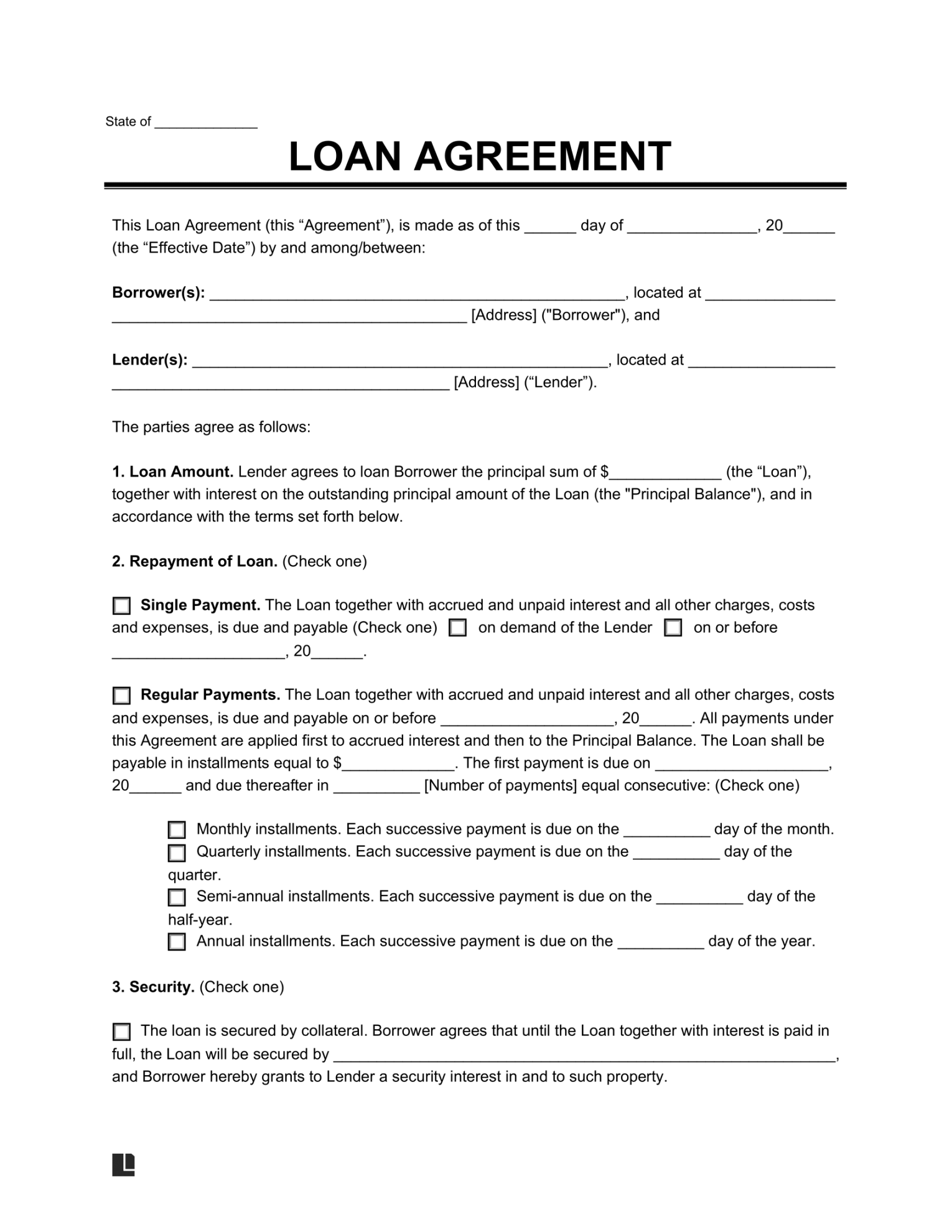

Key Elements of a Professional Debt Agreement Template

Image Source: legaltemplates.net

A well-crafted debt agreement template should include the following key elements:

1. Parties Involved

Borrower: Clearly identify the individual or entity that owes the debt. Include their full legal name, address, and contact information.

2. Debt Amount

Principal Amount: State the original amount of the debt, including any interest accrued up to the agreement date.

3. Repayment Schedule

Payment Amount: Indicate the amount to be paid in each installment.

4. Default and Remedies

Default: Define what constitutes a default, such as missed payments or failure to comply with other terms.

5. Governing Law and Dispute Resolution

Governing Law: Indicate the jurisdiction whose laws will govern the agreement.

Design Elements for Professionalism and Trust

A well-designed debt agreement template can enhance its credibility and professionalism. Consider the following design elements:

1. Clear and Concise Language

Avoid Legal Jargon: Use plain language to make the agreement easy to understand.

2. Consistent Formatting

Font: Choose a professional and easy-to-read font, such as Times New Roman or Arial.

3. Professional Layout

Margins: Use standard margins to ensure a clean and professional appearance.

4. Professional Branding

letterhead: Include a professional letterhead with your company logo and contact information.

5. Legal Review

Conclusion

By incorporating these key elements and design principles, you can create professional debt agreement templates that are both legally sound and visually appealing. These templates will help you effectively manage debt obligations and build trust with your clients.