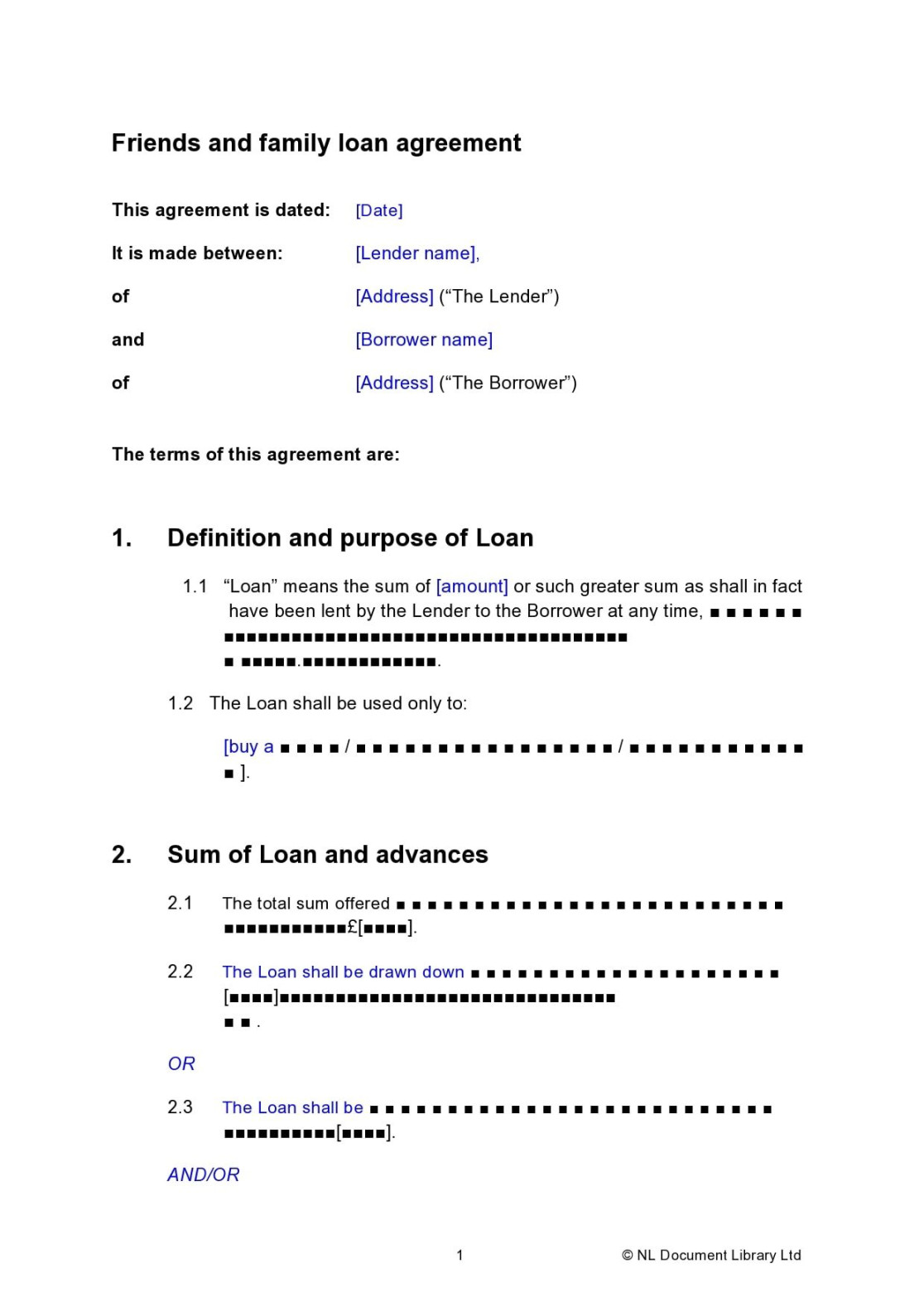

A family loan agreement template is a crucial document that outlines the terms and conditions of a loan between family members. It provides a clear and legally binding framework, ensuring transparency and preventing misunderstandings. While it may seem unnecessary for a family loan, a well-drafted agreement can safeguard relationships and protect both the lender and the borrower.

Key Elements of a Family Loan Agreement

A comprehensive family loan agreement typically includes the following essential elements:

Image Source: pinimg.com

1. Loan Amount and Terms

Loan Amount: Clearly state the exact amount of money being loaned.

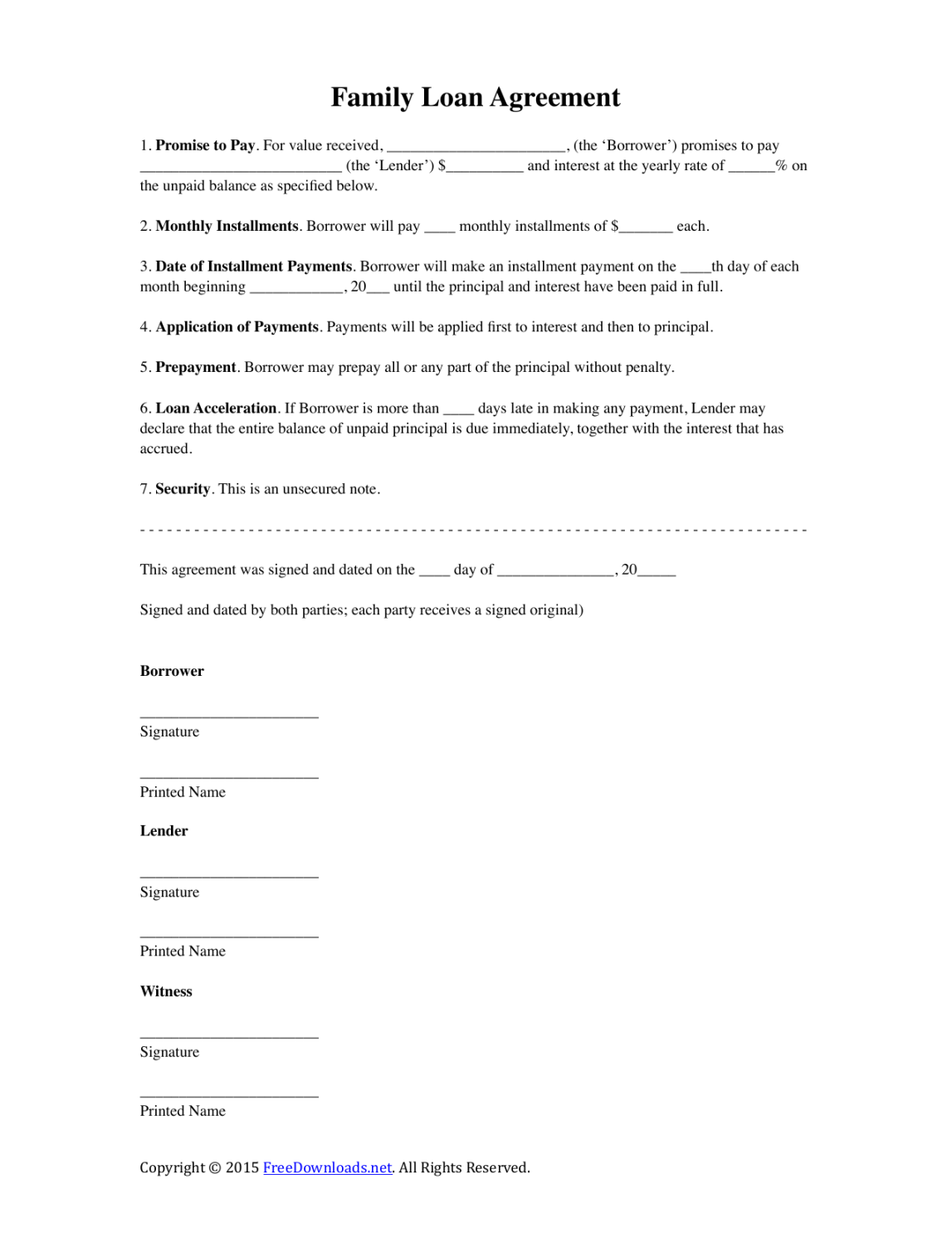

2. Default and Late Payment

Image Source: freedownloads.net

Default: Clearly define what constitutes a default, such as missed payments or failure to meet other terms of the agreement.

3. Security Interest (Optional)

Collateral: If applicable, describe any collateral that is being pledged to secure the loan. This could include property, vehicles, or other valuable assets.

4. Governing Law and Dispute Resolution

Governing Law: Specify the jurisdiction whose laws will govern the agreement.

5. Signatures

Design Tips for a Professional Family Loan Agreement

While the content of the agreement is paramount, the design can also significantly impact its professionalism and trustworthiness. Here are some design tips to consider:

1. Clean and Minimalist Layout:

White Space: Utilize ample white space to enhance readability and create a clean, uncluttered appearance.

2. Clear and Concise Language:

Plain Language: Avoid legal jargon and use clear, concise language that is easy to understand.

3. Professional Header and Footer:

Company Logo: If applicable, include your company logo in the header or footer.

4. Professional Signature Block:

Signature Lines: Provide clear signature lines for both the lender and the borrower.

5. Legal Disclaimer (Optional)

Free Family Loan Agreement Templates

Numerous online resources offer free family loan agreement templates. These templates can serve as a starting point, but it’s essential to customize them to fit your specific needs and ensure they comply with local laws and regulations.

Conclusion

A well-crafted family loan agreement can foster trust, transparency, and peace of mind within family relationships. By following these guidelines and design tips, you can create a professional and legally sound document that protects the interests of both the lender and the borrower.