What is a Promissory note ?legal contract between a lender and a borrower. The borrower promises to repay the loan amount, along with interest, within a specified timeframe. In a personal loan context, this document solidifies the financial agreement between friends, family, or individuals who aren’t formal financial institutions.

Key Elements of a Promissory Note

To create a professional and legally sound Promissory Note, it’s crucial to include the following elements:

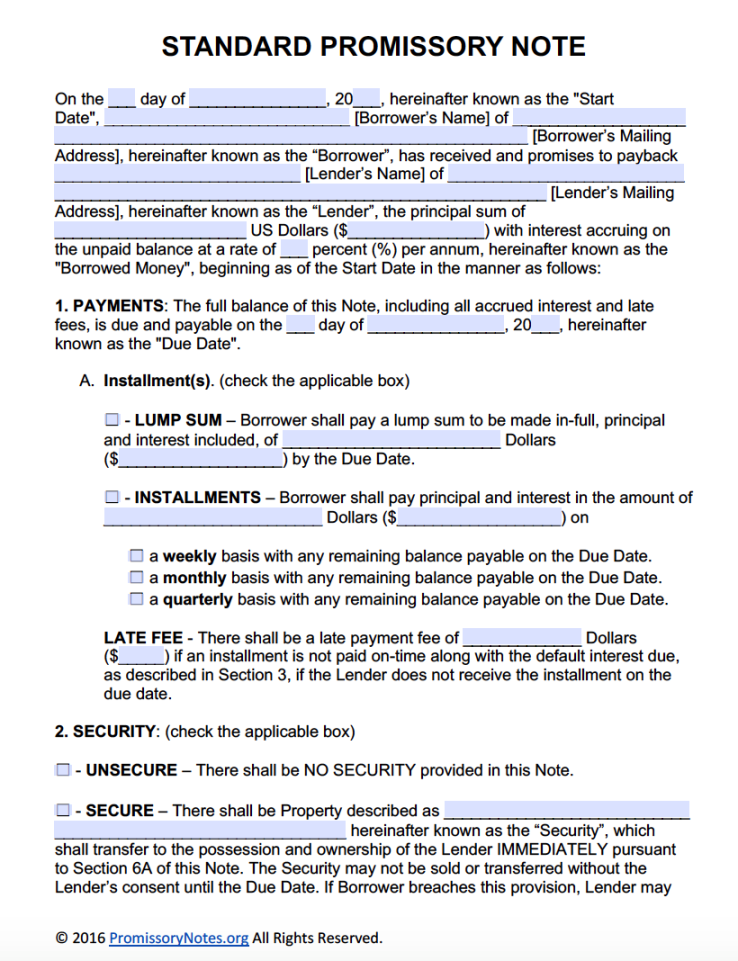

+ FREE Promissory Note Templates [Secured & Unsecured ] Image Source: templatelab.com

1. Borrower’s Information

Full Legal Name: Clearly state the borrower’s complete legal name.

Address: Provide the borrower’s physical address.

Contact Information: Include the borrower’s phone number and email address.

2. Lender’s Information

Full Legal Name: Clearly state the lender’s complete legal name.

Address: Provide the lender’s physical address.

Contact Information: Include the lender’s phone number and email address.

3. Principal Amount

Loan Amount: Specify the exact amount of money being borrowed.

Currency: Indicate the currency in which the loan is denominated (e.g., USD, EUR, GBP).

Free Promissory Note Template – Adobe PDF & Microsoft Word Image Source: promissorynotes.org

4. Interest Rate

Annual Percentage Rate (APR): Clearly state the annual interest rate charged on the loan.

Interest Calculation Method: Specify how interest will be calculated (e.g., simple interest, compound interest).

5. Repayment Schedule

Payment Amount: Indicate the amount of each payment.

Payment Frequency: Specify how often payments will be made (e.g., monthly, quarterly, annually).

Payment Due Date: Clearly state the date on which each payment is due.

6. Default Clause

Default Definition: Define what constitutes a default (e.g., missed payments, breach of terms).

Consequences of Default: Outline the penalties or actions that may be taken in case of default (e.g., acceleration of the loan, legal action).

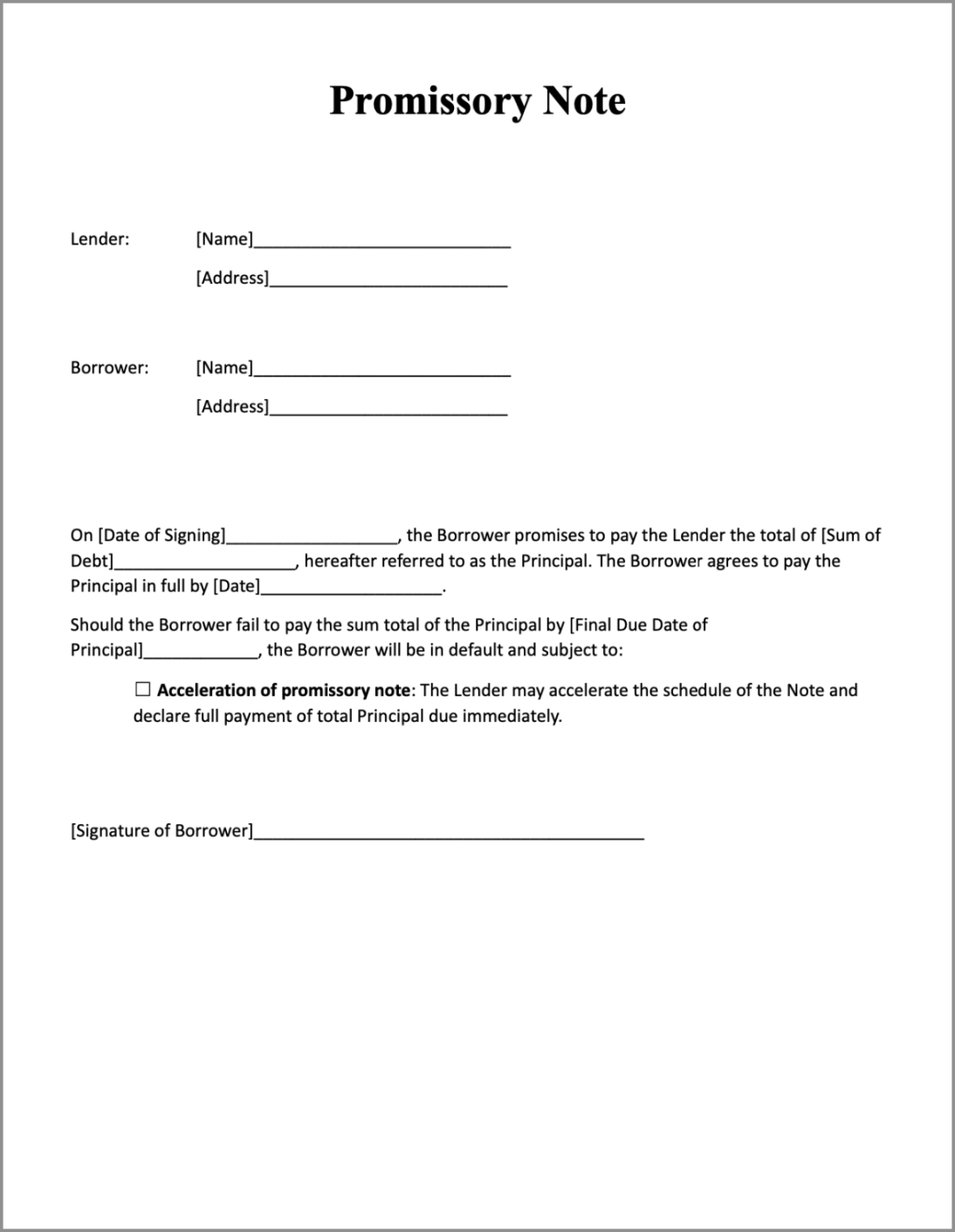

Download Free Promissory Note Template in Word and PDF Signeasy Image Source: website-files.com

7. Governing Law

Jurisdiction: Specify the jurisdiction whose laws will govern the promissory note.

8. Signatures

Borrower’s Signature: The borrower must sign the note to indicate their agreement to the terms.

Date of Signing: The date on which the borrower signs the note.

Lender’s Signature: The lender must also sign the note to acknowledge the loan agreement.

Date of Signing: The date on which the lender signs the note.

Design Tips for a Professional Promissory Note

A well-designed Promissory Note not only conveys professionalism but also enhances its legal standing. Consider these design elements:

1. Clean and Minimalist Layout

White Space: Use ample white space to improve readability and create a clean, uncluttered appearance.

Font Choice: Select a professional and easy-to-read font, such as Times New Roman or Arial.

Font Size: Use a font size that is large enough to be easily read, but not too large to overwhelm the page.

2. Professional Header and Footer

Document Title: Clearly label the document as a “Promissory Note.”

Page Numbering: Include page numbers to organize the document.

Date: Add the date of the document creation.

3. Clear and Concise Language

Plain Language: Use simple, straightforward language that is easy to understand.

Avoid Legal Jargon: While legal terms may be necessary, use them sparingly and explain them clearly.

4. Consistent Formatting

Paragraph Formatting: Use consistent paragraph formatting, including indentation and line spacing.

Headings and Subheadings: Use headings and subheadings to organize the content and improve readability.

Bullet Points: Use bullet points to list key information, such as the repayment schedule or default terms.

5. Professional Signature Block

Signature Lines: Provide clear signature lines for both the borrower and lender.

Printed Name: Include lines for the printed names of the borrower and lender.

Date Lines: Provide lines for the date of signing.

Creating Your Promissory Note Template

You can create a professional Promissory Note template using various tools:

1. Word Processing Software (Microsoft Word, Google Docs):

Templates: Utilize built-in templates or create your own.

Customization: Customize the template to match your specific needs.

Formatting: Apply professional formatting, including fonts, spacing, and alignment.

2. Online Form Builders:

![+ FREE Promissory Note Templates [Secured & Unsecured ] + FREE Promissory Note Templates [Secured & Unsecured ]](https://theroyalmen.com/wp-content/uploads/2024/11/free-promissory-note-templates-secured-amp-unsecured.jpg)