An Interest invoice Template is a crucial document used to formally request payment for interest accrued on overdue invoices or outstanding debts. It serves as a clear and concise record of the additional charges incurred due to delayed payment. A well-designed Interest Invoice Template not only ensures accurate billing but also reinforces your company’s professional image and strengthens your financial position.

Key Elements of a Professional Interest Invoice Template

To create an effective Interest Invoice Template, consider incorporating the following essential elements:

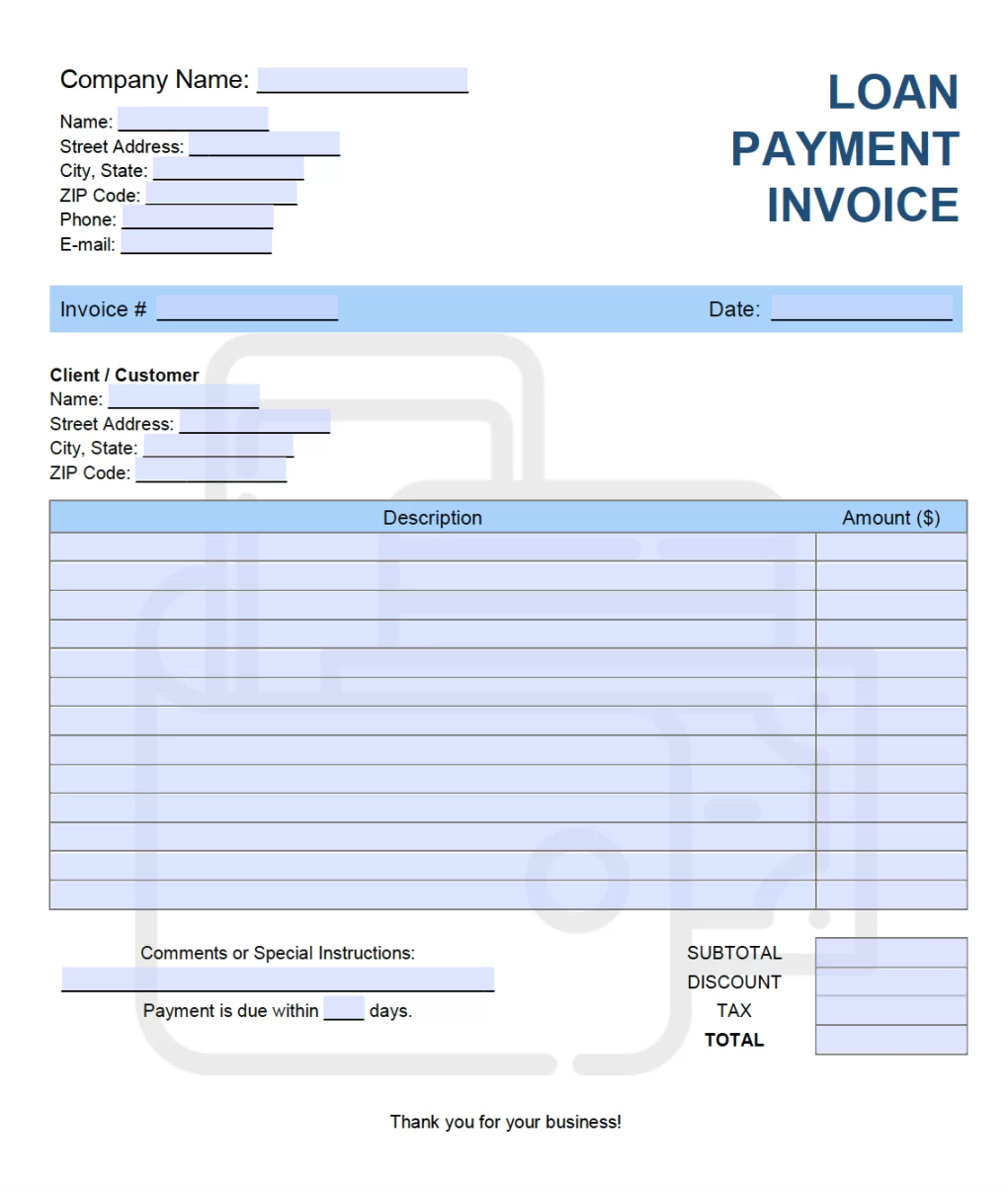

Image Source: invoicegenerator.org

1. Company Logo and Contact Information

Company Logo: Position your company’s logo prominently at the top of the template. This reinforces brand recognition and adds a touch of professionalism.

2. Invoice Number and Date

Invoice Number: Assign a unique invoice number to each Interest Invoice to facilitate easy tracking and reference.

3. Client Information

Client Name: Specify the full name or company name of the client who owes the interest.

4. Invoice Summary

Original Invoice Number: Reference the original invoice number to which the interest charges apply.

5. Interest Calculation

Detailed Breakdown: Provide a detailed breakdown of the interest calculation, including the formula used and the specific calculations involved. This transparency builds trust and demonstrates accuracy.

6. Total Amount Due

Sum of Original Invoice and Interest: Calculate the total amount due by adding the original invoice amount and the accrued interest.

7. Payment Terms

Payment Due Date: Specify the date by which the payment should be received.

8. Contact Information for Inquiries

Dedicated Contact Person: Specify a contact person for any inquiries or concerns related to the Interest Invoice.

9. Professional Design Elements

Clean and Minimalist Layout: A clean and clutter-free layout enhances readability and professionalism.

10. Legal Disclaimer (Optional)

By incorporating these elements and adhering to professional design principles, you can create an Interest Invoice Template that effectively communicates your financial expectations, reinforces your brand image, and facilitates timely payments.