A non-recourse loan agreement is a legal contract outlining the terms and conditions of a loan where the lender’s rights are limited to the specific collateral securing the loan. In simpler terms, the borrower’s personal assets are not at risk in the event of default. This type of loan is often used in real estate transactions, particularly for commercial properties.

Key Elements of a Non-Recourse Loan Agreement

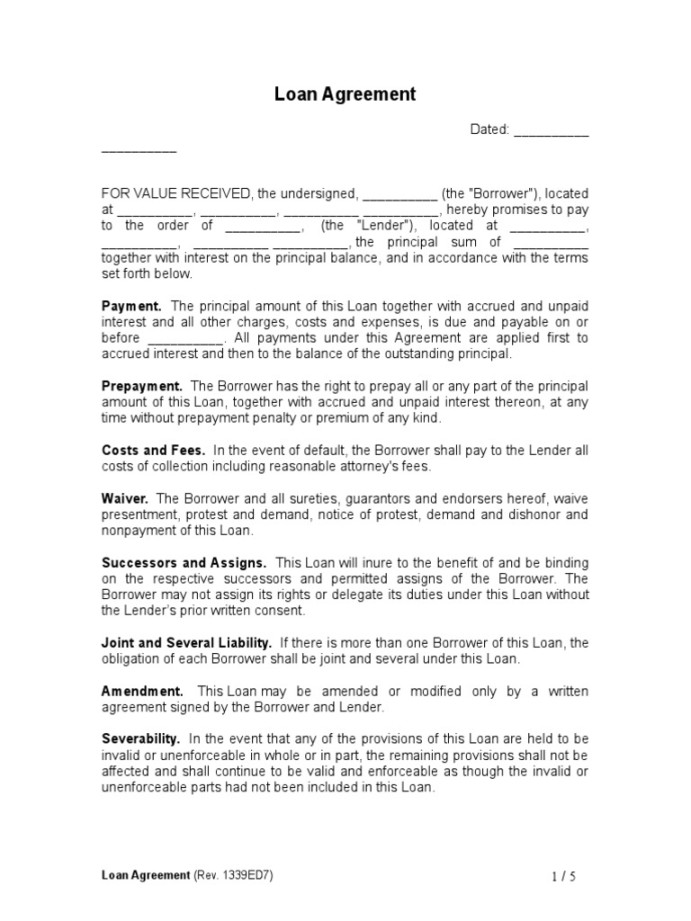

A well-drafted non-recourse loan agreement should include the following essential elements:

Image Source: scribdassets.com

1. Parties Involved

Borrower: Clearly identify the individual or entity borrowing the funds.

2. Loan Amount and Terms

Principal Amount: State the exact amount of money being loaned.

3. Collateral

Description of Collateral: Provide a detailed description of the assets securing the loan.

4. Default

Events of Default: Define specific events that would trigger a default, such as missed payments or breach of contract.

5. Non-Recourse Clause

Limitation of Liability: Clearly state that the borrower’s personal assets are not liable for the loan.

6. Governing Law and Dispute Resolution

Governing Law: Specify the jurisdiction whose laws will govern the agreement.

7. Representations and Warranties

Borrower’s Representations: Require the borrower to make specific representations and warranties about their financial condition, title to the collateral, and compliance with laws.

8. Covenants

Affirmative Covenants: Outline obligations the borrower must fulfill, such as maintaining insurance on the collateral or providing financial statements.

Design Considerations for a Professional Template

To create a professional and trustworthy non-recourse loan agreement template, consider the following design elements:

1. Clear and Concise Language

Plain Language: Use clear and concise language, avoiding legal jargon whenever possible.

2. Professional Formatting

Consistent Formatting: Use consistent fonts, font sizes, and spacing throughout the document.

3. Legal Review

4. Customization

Tailor to Specific Needs: Customize the template to fit the specific needs of each transaction.

By carefully considering these elements, you can create a professional and effective non-recourse loan agreement template that protects the interests of both the lender and the borrower.