A Payment Terms Agreement Template is a crucial document that outlines the financial conditions between two parties involved in a business transaction. This document is essential for both businesses and individuals, as it ensures clarity, transparency, and legal protection for all parties involved.

Key Elements of a Payment Terms Agreement Template

A well-crafted Payment Terms Agreement Template typically includes the following essential elements:

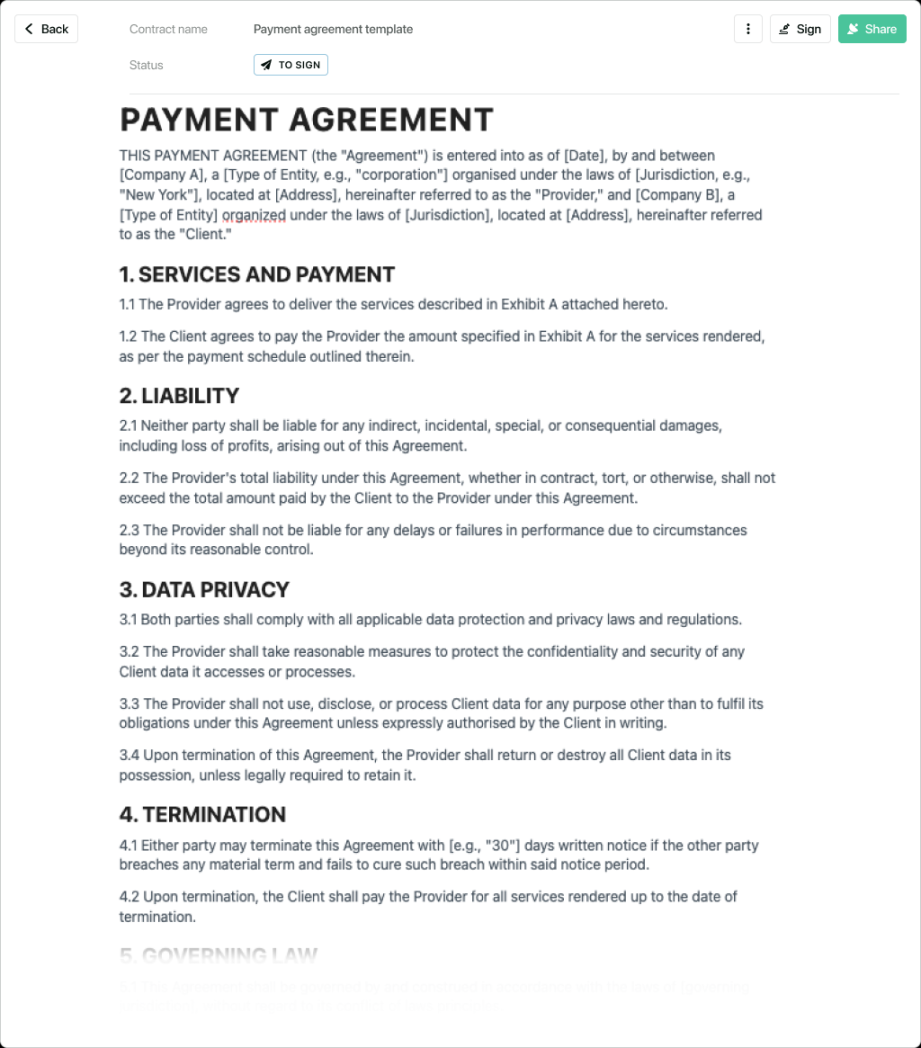

Image Source: website-files.com

1. Parties Involved

Clearly identify the parties: Specify the full legal names of both parties involved in the agreement.

2. Payment Terms

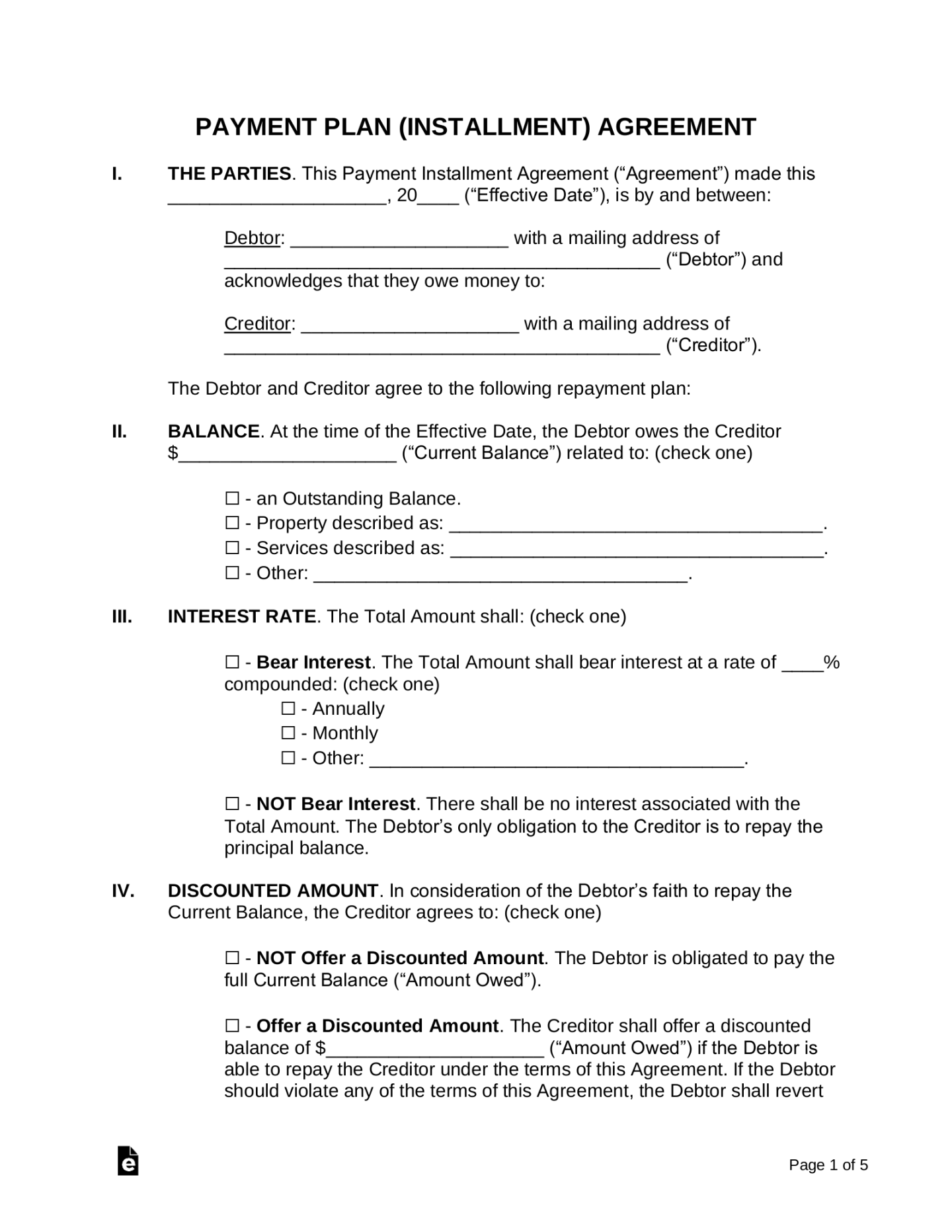

Image Source: eforms.com

Payment schedule: Outline a clear payment schedule, specifying the due dates for each payment.

3. Invoicing

invoice frequency: Determine how often invoices will be issued.

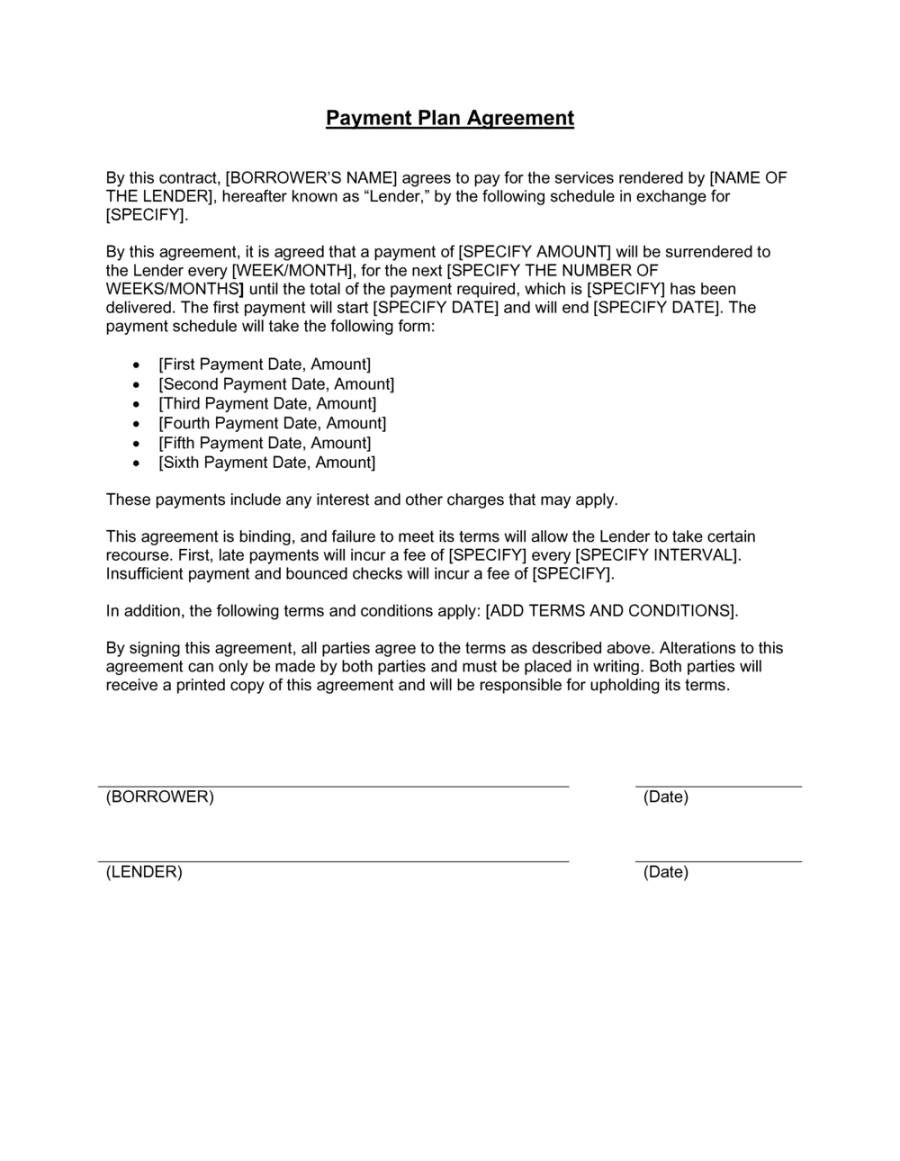

Image Source: business-in-a-box.com

4. Dispute Resolution

Dispute resolution process: Outline the procedure for resolving any disputes that may arise.

5. Termination

Termination conditions: Define the conditions under which either party may terminate the agreement.

6. Force Majeure

Define force majeure events: Specify events beyond the control of either party, such as natural disasters or acts of God.

7. Confidentiality

Confidential information: Identify any confidential information that may be shared between the parties.

8. Entire Agreement

Complete agreement: State that the agreement constitutes the entire understanding between the parties.

9. Modifications

Modification process: Specify the process for modifying the agreement.

10. Severability

Design Elements for a Professional Payment Terms Agreement Template

The design of your Payment Terms Agreement Template is just as important as its content. A well-designed template can enhance its professionalism and credibility. Here are some design tips:

1. Use a Clean and Professional Font:

Choose a font that is easy to read: Opt for fonts like Times New Roman, Arial, or Calibri.

2. Use Clear and Concise Language:

Write in plain English: Avoid legal jargon and technical terms that may confuse the reader.

3. Use Headings and Subheadings:

Organize the content: Use headings and subheadings to break up the text and make it easier to read.

4. Use White Space Effectively:

Create a clean and uncluttered layout: Use white space to separate different sections of the document.

5. Use a Professional Layout:

Align text and numbers: Align text and numbers to create a neat and organized appearance.

6. Use a Professional Logo:

7. Use a Professional Template:

Use a pre-designed template: Use a pre-designed template to save time and ensure a professional look.

By incorporating these design elements, you can create a Payment Terms Agreement Template that is both professional and easy to understand.