What is a Payoff letter Template?

A payoff letter template is a pre-designed document that outlines the final payment for a loan or mortgage. It’s a crucial tool for borrowers to ensure that their final payment is accurate and complete. By using a professionally designed template, borrowers can save time, reduce errors, and maintain a clear record of their financial transactions.

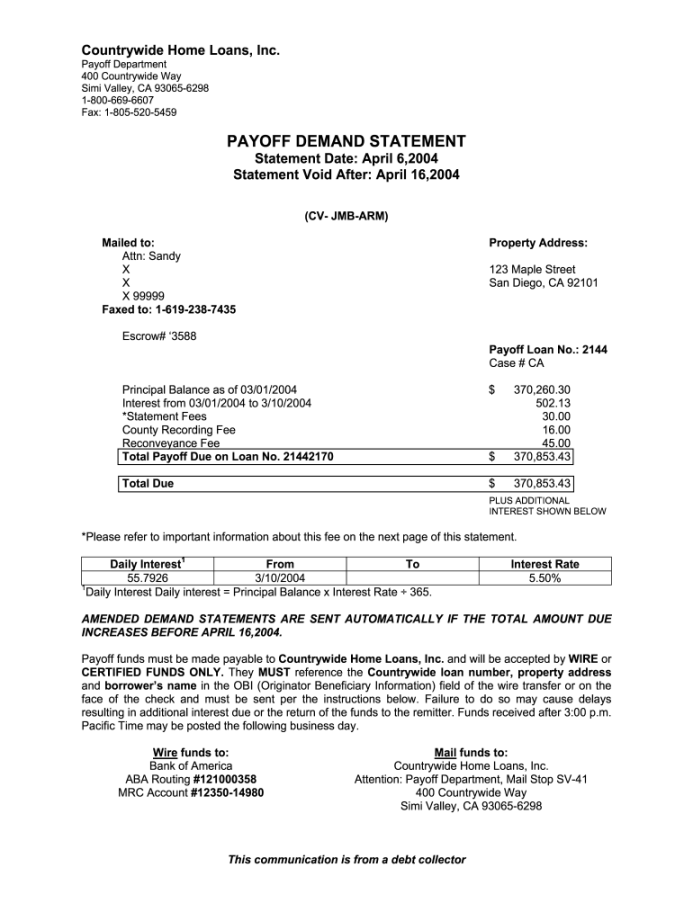

Key Elements of a Professional Payoff Letter Template

Image Source: pdffiller.com

A well-crafted payoff letter template should include the following essential elements:

1. Borrower Information

Full Name: Clearly state the borrower’s full name.

2. Payment Information

Payment Amount: Clearly state the total amount required to pay off the loan in full.

3. Payment Deadline

Due Date: Clearly state the deadline by which the payment must be received.

4. Contact Information

Lender’s Name: Specify the name of the lending institution.

5. Acknowledgment and Verification

Payment Confirmation: Include a section where the borrower can acknowledge receipt of the payoff letter.

Designing a Professional Payoff Letter Template in WordPress

1. Choose a Clean and Minimalist Theme

Simplicity: Opt for a theme that prioritizes clean lines and a minimalist design. Avoid cluttered layouts and excessive visual elements.

2. Create a Clear and Concise Layout

White Space: Utilize white space effectively to improve readability and create a visually appealing layout.

3. Use High-Quality Formatting

Formatting: Use consistent formatting throughout the template, including font size, font style, and line spacing.

4. Include a Professional Letterhead

Company Logo: Incorporate the lender’s logo at the top of the letterhead.

5. Customize the Template for Different Loan Types

Flexibility: Design the template to accommodate various loan types, such as mortgages, auto loans, and personal loans.

6. Test and Refine the Template

Thorough Testing: Test the template with different data to ensure that it functions correctly and looks professional.

By following these guidelines, you can create a professional and effective payoff letter template that will streamline the loan payoff process for both borrowers and lenders.